Comments of the Polish Biogas Association on the Ministry's Proposed Biogas Auction Reference Prices

POLISH BIOGAS ASSOCIATION COMMENTS ON SUGGESTED REFERENCE PRICES

September 2015

The proposed

reference prices released by the Ministry of Economy for the first auctions

under the new law significantly understate the support necessary for anaerobic

digestion plants. The numbers proposed are as follows:

1)

agricultural biogas plants with a capacity of 1 MW - 450 zł / MWh

2)

agricultural biogas plants with a capacity exceeding 1 MW - 435 zł / MWh

3)

biogas plants using biogas from landfills - 210 zł / MWh

4)

biogas plants using biogas from wastewater treatment plants - 400 zł / MWh

5)

biogas plants using biogas other than in paragraphs 3 and 4 - 340 zł / MWh

Analysis

There is no data

from any source that we are aware of to support the price set in the proposal

for agricultural biogas under items 1 and 2. Basic biogas costs for agricultural

plants of various sizes were set out by the European Biogas Association in

2010. See graphic below. Recent studies

show that these costs have not gone down and are slightly increasing. See

below.

The cost of producing biogas energy is

also well-documented in other reports.

The Fraunhofer Institute in Germany reported German prices for all types

of biogas to be between 14 and 21 Euro cents/kWhr. “Levelized Cost of Electricity Renewable

Energy Sources,” November 2013. A Club

of Bologna study in 2012 also reported a similar range of prices:

“"The

electricity generating costs decrease with increasing plant size and amount from

about 15 to 25 Ct/kWhel." Id. This is very consistent

with both the EBA and Fraunhofer numbers. Somewhat higher figures were reported

in a study for the Oxford University Institute for Energy Studies – 18 to 34

Euro cents/kWhr. Floris van Foreest, “Perspectives

for Biogas in Europe ,” NG 70, December

2012.

The

published proposal is inconsistent with the data and analyses supplied by the

Institute for Renewable Energy that studied the subject in detail in 2013. IEO expressed the cost of production by a

coefficient for green certificate values added to the price of electricity.

RES installation to support with "green certificates"

system

|

Technology code

|

2013***

|

2017****

|

|||

OSR*

|

IEO**

|

OSR

|

IEO

|

|||

agriculture biogas 200-500 kW

|

T1

|

1.50

|

2.89

|

1.41

|

2.98

|

|

agriculture biogas 500-1000 kW

|

T2

|

1.45

|

2.49

|

1.36

|

2.58

|

|

agriculture biogas >1000 kW

|

T3

|

1.40

|

2.19

|

1.32

|

2.26

|

|

landfill biogas > 200 kW

|

T4

|

1.10

|

-

|

1.00

|

||

water treatment plant biogas >200 kW

|

T5

|

0.75

|

1.30

|

0.67

|

1.24

|

|

Source: IEO, “Analiza

Dotycząca Możliwości Określenia Niezbędnej Wysokości Wsparcia Dla

Poszczególnych Technologii Oze W Kontekście Realizacji „Krajowego Planu

Działania W Zakresie Energii Ze Źródeł Odnawialnych,” 2013.

These figures range from 27 to 21 Euro

cents/kWhr for agricultural biogas and are based on Polish data, somewhat

higher than the other reported data using 2013 real cases.

There

is also no indication that the cost of biogas energy production is going down

as it is with other technologies. “Despite the increase in the

efficiency of biogas production, rising costs of the manufacturing of plant

components and the substrates (biomass) further cost reductions are not

expected anymore.” Döhler and Paterson , supra.

“Improvement of the technical, economic and ecological efficiency of

biogas production -future challenges for the agricultural engineering sector,” Helmut

Döhler and Mark Paterson( 2012).

None of the published data supports the

450 PLN/MWhr figure (only 10.7 Euro cents/kWhr).

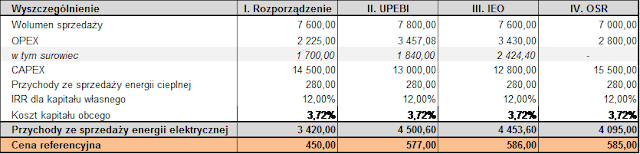

The methodology used by the Ministry seems

to be fatally flawed in several ways. The operating costs are inordinately low

and are inconsistent with IEO and every other study we have seen. See table below.

The assumption that projects will always

to able to sell heat is inconsistent with the experience on farm-based plants,

which are at the heart of the policy of the Council of Ministers. The IEO, OSR and UPEBI results are comparable

to the published data cited above, while the Ministry’s proposed reference

price is seriously at odds with all published reports.

Source: UPEBI (September 2015).

PBA also

questions the use of a 5% return, especially since Poland agreed to a 15%

return[1] in

evaluating Joint Implementation projects under the Kyoto Protocol. See CDM

Methodology for Additionality. No one is compelled to make these investments

and the equity markets move funding to the areas of highest return. The history of biogas in Poland is

instructive, from 2005 to 2011, with electricity and Green Certificates, biogas

plants could receive about the same 450 PLN/MWhr as proposed now. Only a

small number have been built and those have largely relied upon government

grants for a substantial part of their capital costs.[2] History has proven that more support than

this level is necessary to drive investment in this sector.[3] The

uncertainty of the auction also makes the incentives worse.

The final

category of “other biogas” – item 5 – includes anaerobic digestion of

substrates within the definition of biogas in the new law, including some

material not listed in “agricultural biogas.” There is no basis for setting “other

biogas” lower than agricultural biogas, because this category also involves

having to construct anaerobic digesters to produce methane. The material

handling issues for these more complex plants are larger and more costly than

farm plants. These AD plants use organic wastes and biodegradable material from

a broader range of sources. However, the cost of these AD plants is higher than

“agricultural plants” since they must normally provide pre-treatment of

substrates, operate at higher temperatures, and provide a higher degree of

environmental protection and odor control. Their reference price should be at

least the same as “agricultural plants.”[4]

Conclusion

Biogas plays a vital

role in the plans to meet the 2020 target in Poland. The current National

Action plan approved by the European Commission calls for 980 MW of biogas by

2020. The draft Energy Plan for 2050 lowers that number, but calls for 1800 MW

of biogas by 2050 in Poland. These are

ambitious goals given the very low level of market development of biogas in

Poland in 2015.

The statutory

criteria require that the differences in support be based on objective factors,

principally the cost of production. Biogas has the further advantage under

these criteria providing more reliable and stable electricity than most other

sources as well as meeting other important policy objectives.

There appears to

be no objective and factual basis for the low reference price levels proposed

for biogas. There is also no hope whatsoever of achieving the policy goals for

biogas at this level of support.

PBA urges the

Ministry to review the actual cost of production and to re-formulate biogas

reference prices based on actual data.[1]

We have provided numerous European sources on the subject as attachments to

these comments.

Respectfully submitted,

Polish Biogas Association

Randy M. Mott, Vice president

September 2015

[1] The availability of co-generation support

(now uncertain) as well as grants obviously may provide more support in some

cases. But neither of these support mechanisms is assured or adequate to

provide for the level of biogas development in the approved government policies

on biogas.

[1] The IRR used is a pro forma figure, which often makes

assumptions that do not turn out as beneficial in reality. But without an

attractive estimate of the return at the beginning of the investment

assessment, there will be no funding.

[2] There will never be

enough government grant funding to create a significant part of the 1800 MW of

biogas described in the Government’s draft Energy Plan for 2050. Nor will

grants constitute a significant fraction of the 980 MW target for biogas in

2020 (or the lower 2020 figure in the 2050 document). If grants are used, a

project will automatically have a lower reference price under the state aid

intensity test in any event.

[3] German biogas

development, often cited as the model by Polish officials, provided much higher

levels of support than now proposed in Poland. See Spath,”The Success Factors Of The Development Of Biogas Within

Germany - A Case Study,” University of

Twente, 2013 (thesis). German CAPEX and OPEX during this period actually

slightly lower than what we face today. See

Döhler and Paterson, supra,

graphic above.

[4] PBA also has requested that “other biogas”

plants be allowed to take 20% sewage sludge by volume and not be classified

“sewage treatment plants.” This is the

rule applied in Denmark and it provides many benefits to local communities. The

only rationale for a lower reference price is lower cost of production of

energy. This occurs at sewage treatment plants where methane collection is

simply added to existing, required waste water treatment structures. AD plants

using small volumes of sewage sludge have the same or higher costs than farm

plants and cannot be fairly classify in this other distinct category.

Comments

Odor Control Indian River