ANALYZING THE TRUE COST OF RENEWABLE ENERGY

Randy Mott, Vice president, Polish Biogas Association

After over three

years of debate and discussion and multiple versions of the proposed law and

its regulatory impact, the Polish Government has never provided a realistic

economic analysis of the impact of support for renewable energy. The

simplistic model used by the government simply adds up the support for various

types of renewable energy and creates a static total price tag. “Savings” and

“optimization” are only viewed as a function of their measurement on the total

price tag. There is abundant actual evidence that a reasonable support

system on the Polish current model can be effective without having major price

impacts.

The actual economic

cost of renewable energy on end-users, which is what the government professes

to care about, cannot be viewed as simply the total value of the support. The

new capacity created by renewable energy affects supply and demand for

electricity (and heat). A fundamental concept of the free market is that

increased supply lowers prices. This has been analyzed in depth in the United

States under a scenario similar to Poland’s “Residential Portfolio Standard.” A

15% green energy target for the United States (RPS) was projected to only cause

a “cumulative electricity and

natural gas expenditures increase … [of] 0.3%.” U.S. Energy Information Agency, Impacts of a 15 Percent RPS, Chris Namovicz, July 11, 2007, EESI Briefing. The same effect was noted in a review of state RPS programs in the United States: “A review of state-level RES policies shows that utilities are

successfully meeting their annual renewable energy requirements with little

or no additional cost to consumers (emphasis added).” How can such a

massive undertaking have so small a price impact on consumers? The answer

is in several of the details ignored in the Polish Government analysis. For

one, the net operating cost of renewables is lower than conventional fossil

fuel operating costs. Local renewable

sources also reduce transmission costs. And all new renewable energy capacity

increase competition. The net impact on consumers is always lower than

the static total amount of support provided.

Source: Union of

Concerned Scientists, “How

Renewable Electricity Standards

Deliver

Economic Benefits,” May 2013 Cambridge,

Massachusetts.

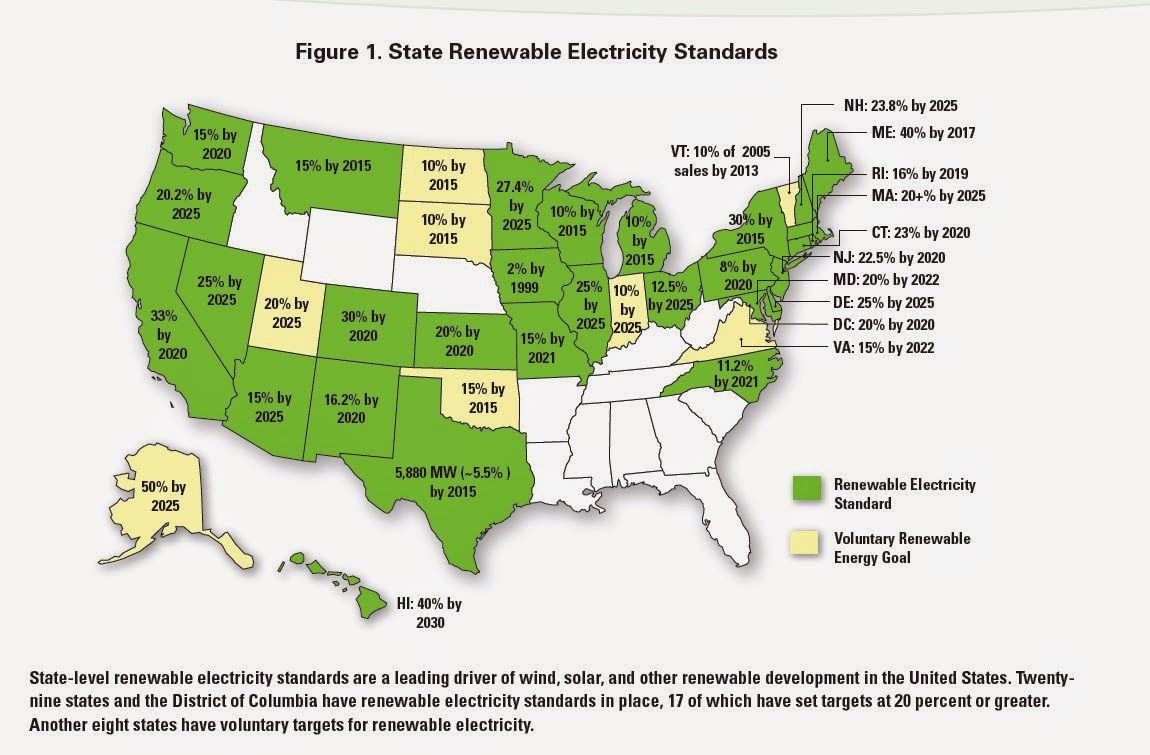

Europeans often forget that the United

States has 50 states that each has its own energy policies in this area. See UCS

graphic. They are a regulatory workshop and can provide a good deal of

experience, especially in this case since they generally use the same type of

RPS as Poland.

“Collectively, the renewable energy requirements established by

RES policies apply to more than 50 percent of total U.S. electric demand

(Barbose 2012).” Union of Concerned Scientists, May 2013, supra. Yet this green electricity now totaling over

100,000 MWs has not had a major impact on consumer prices: “The Lawrence Berkeley National Laboratory,

having recently evaluated 2009 and 2010 RES compliance-cost data that were

available for 14 states, estimated that all but one state experienced cost

impacts of about 1.6 percent or less (Barbose 2012).” UCS, supra, citing Lawrence Berkeley

National Laboratory (LBNL) 2013. LBNL

RPS compliance data spreadsheet, Berkeley, CA. Online at http://www.dsireusa.org/rpsdata/,

accessed April 1, 2013. The support mechanisms used are the same approach as Poland’s

system:

“Most states with

RPS programs have associated renewable energy

certificate trading

programs. RECs provide a mechanism by which to track the amount of renewable

power being sold and to financially reward eligible power producers. For each

unit of power that an eligible producer generates, a certificate or credit is

issued. These can then be sold either in conjunction with the underlying power

or separately to energy supply companies. A market exists for RECs because

energy supply companies are required to redeem certificates equal to their

obligation under the RPS program. State specific programs or various

applications (e.g., WREGIS, M-RETS, NEPOOL GIS) are used to track REC issuance

and ownership. “[1]

The experience and data from past

performance in states with RPC programs establishes the fact that a Polish

style “quota” system backed by Green Certificates can theoretically work quite

well to both achieve the desired mix of renewable energy and to do so with a

modest impact on end-user prices.

Applying

these lessons to Poland, which uses a similar support system, it is clear that

the Green Certificate program here was overly expensive and abused. Co-firing

of biomass with coal, which has a nominal cost according to the Polish

Institute for Renewable Energy, received the largest amount of support and created

no new electricity production capacity. This type of policy will have the

maximum impact of consumers in the form of a higher price with little or no

mitigation.

Similarly, Poland provided old hydro

plants, some of which were pre-war, with another major share of Green

Certificates, although they were depreciated long ago and certainly did not

require any investment incentives. About 70% of the Green Certificates have

been awarded without creating new electrical capacity. The impact of this

policy on end-user prices was nearly a one-to-one price increase. They bought

the same electricity from the same places, it just cost more!

Support for renewable energy producers which

adds new capacity to the supply of electricity operates in a fundamentally

different economic way. A substantial body of data from multiple sources in the

United States supports the notion that renewable energy supported in the RPS

programs does not have a major adverse impact of end user prices.[2] However,

it is clearly possible to abuse the support system, especially feed-in tariffs,

is a manner that causes over-compensation and higher prices to electricity

customers. The support systems in Germany and other countries where the impact

on end users is much higher were enormously more bloated than the Polish

green certificate system. German solar producers got between 46-57 Euro

cents per kilowatt, while the Polish system to date offers about 11.5 Euro

cents (if Green Certificates are at 100% value). German biogas plants got

between 25 and 40 Euro cents per kilowatt, again compared to 11.5 cents in Poland.

Because of the higher feed-in tariffs, much more capacity was built in Germany

than predicted when the impact of consumers was initially projected: for

example, in 2010, "7,400 MW of solar

panels were installed; six times as much as estimated in the reference scenario

used by the environment minister." [Daniel Wetzel, Die Wel,

October 25, 2012]. Similarly, in Spain, the solar subsidies got

adjusted to a level that proved excessive to consumers. "The payment for PV solar was set at 41.4 eurocents per kWh, with

the Spanish government anticipating 400 MW of installed PV solar between 2007

and 2010. However, the high rate that was set for PV solar spurred developers

to install 344 MW of PV solar in the first nine months of 2007 alone."

Environmental and Energy Study Institute (2012). "Due to the Spanish government’s subsidization of electricity,

there was a cost to Spanish taxpayers

totaling over $1.4 billion. In response, the Spanish government imposed a cap

of 500 MW for PV solar in 2009 and reduced the payments to 32-34 eurocents per

kWh. " Id. The Czech solar subsidies were also excessively high ($700

MWhr or 55 Euro cents a kilowatt hour) and resulted in a disaster to consumers

of electricity: "The result was a

more than 24,000 percent increase in Czech solar energy plants, from nine in

2005 to more than 2,230 by January 2010, making the Czech Republic the

third-largest solar energy producer in Europe, despite the country's relatively

small size." Prague Post, March 24, 2010. The problem has been that

subsidies three or four times higher than Polish levels then lead to excessive

development of the technology and create an even greater cost multiplier.

The problem that the Member States with

hyper-support schemes have to now to adjust new support to lower the average

support provided to a reasonable level. The overly generous levels are

generally under long-term commitments and the only corrective adjustment that

the governments can make is to seriously lower new support levels. Poland

absolutely does not have this issue.

However, when the Polish politicians try

to use the experiences of overcompensation in other countries to cut support

here, they are being disingenuous. Those high levels of support have nothing

relevant to say about the current or proposed Polish system. As long as the

support is only offered to technologies that add capacity and is levelized

across technologies to avoid overcompensation, there is no indication that the

impact of user prices will be serious. The Polish Institute for Renewable

Energy study makes a major effort to define these coefficients and should only

be ignored in the new law based on more compelling actual data, not political

decisions.

In the same vein, the price for renewable

energy in Poland is often compared to coal-fired electricity. The problem with

this comparison is that the coal-fired data reflect historical cost data

based on old coal-fired plants built in the 1960s that are being closed due

to the infeasibility of their meeting EU emission limits after the

grandfathered date of 2015. The true cost of coal-fired energy would reflect

compliance with these emission standards for SO2 and NOx and other pollutants.

The actual cost in the future will also reflect higher coal prices as Poland

imports more foreign coal due to the economics of domestic mining. Finally, the

government subsidies to the coal industry are normally overlooked. See Karaczun

et al. Poland 2050 at the Carbon Crossroads. [3]

In the same vein, the price for renewable

energy in Poland is often compared to coal-fired electricity. The problem with

this comparison is that the coal-fired data reflect historical cost data

based on old coal-fired plants built in the 1960s that are being closed due

to the infeasibility of their meeting EU emission limits after the

grandfathered date of 2015. The true cost of coal-fired energy would reflect

compliance with these emission standards for SO2 and NOx and other pollutants.

The actual cost in the future will also reflect higher coal prices as Poland

imports more foreign coal due to the economics of domestic mining. Finally, the

government subsidies to the coal industry are normally overlooked. See Karaczun

et al. Poland 2050 at the Carbon Crossroads. [3]

The comparative cost of providing electricity from different modern

sources was just analyzed in the United States in January 2013. The data

clearly show that some renewable energy sources are already economically

attractive. These figures also contradict the Prime Minister’s erroneous perception

of the relative cost of energy. The historical Polish situation with coal is certainly not representative of the future.

The fact is that the Polish Government has

pushed to keep electricity prices artificially low, such that it is not

economically to build even new coal plants. The price of all electricity in

the future in Poland will be higher because the price will have to reflect the

investment incentive necessary for growth or the electricity will have to be

imported from more expensive foreign producers. This will not cause a vast amount of

coal-fired energy to disappear (although 7000 MWs are closing by the end of

2015 due to environmental rules). The choice between coal, renewables or

nuclear is a meaningless gesture. Poland will need all of the electricity

capacity that it can construct and operate. The issue is not whether renewable energy will replace coal, but whether

coal energy can meet the Polish user demand and legal requirements of the EU

without renewable energy. The answer is clearly no way.

Renewable energy is a legal necessity

under European law. All of the required objectives can be financially met

without undue economic impact, but only as long as the system is repaired to

satisfy these objectives and not other interests. Up to this point, the system

has been manipulated to reduce the burden of renewable energy obligations on

the state-owned power plants. The RES system can effectively meet the EU target

and do so in a reasonable way, but it cannot serve other masters.

Published in Polish HERE.

[1] http://en.wikipedia.org/wiki/Renewable_portfolio_standard#California

[2] From the Pennsylvania Dept. of Energy fact

sheet, supra: (1) A 2010 analysis of House Bill 2405 by the engineering

consultancy Black and Veach indicates that “…the net present value of the price

suppression benefit over the life of the (bill) could be $3.5 to $6.2 billion

…. Notably this savings is much higher than the direct electricity cost impacts

… ($1.6 billion increase for AEPS). (2) A 2009 PJM Interconnection study of the

impacts of adding wind generation to the market concluded that “…15,000 MW of

wind offers wholesale market price reductions of $4.50-6/MWh, translating to

reductions in annual market-wide expenditures of $3.55 billion to $4.74 billion

versus not having that wind in place.” (3) A 2009 PECO/Exelon study of the

market impact of adding 400 MW of capacity to the Pennsylvania Peach Bottom

Nuclear facility gives further support to the price suppressive effects of low

marginal cost generation: “We estimate conservatively that these benefits would

average $137 million per year in Pennsylvania, and more than $425

million per year in all of PJM-East.” (4) A New York State Energy Research and

Development Authority (NYSERDA) analysis of New York’s Renewable Portfolio

Standard (RPS) estimates that the reduction in wholesale electricity prices

from the addition of renewable energy resources in 2010 is likely to be

approximately $2/MWh (0.2 cents/kWh). (5) A 2009 study by Tudor, Pickering, Holt,

& Co., Energy Investment & Merchant Banking, of the impacts of wind

generation estimated that “…6,500 mw of wind capacity dispatched into the

supply stack significantly impacts prices. Vs. no wind, the marginal price of

off- peak power falls by $20/MWh during peak demand (24%), $15 off-peak (25%).

[3] “…a coal-based energy sector will not ensure

inexpensive energy. Energy infrastructure is slowly becoming degraded.

Replacement costs for this infrastructure – even for coal-based installations –

are estimated at around PLN 200 billion until 202073. In order to repay these

investments, energy prices for final consumers will have to increase. Climate

policy measures and the necessity to incorporate external costs in energy

prices will further increase the cost of coal-based energy.” Poland 2050,

supra, p. 18. Polish coal imports have exceeded exports since 2008 and

there is no reason to think that the trend will reverse. Id.

Comments